A single source of truth for loans—clean, queryable, compliance ready

Ingest loan files and trackers, extract covenants & key fields, and see portfolio analytics in real time. Use standalone for reporting, or pair with Warehouse Engine for automated borrowing base workflows.

Asset Hub pairs naturally with Warehouse Engine (eligibility & advance rate automation), and routes capital via Funding Desk. Planning whole loan sales? See Sales Desk.

Everything you need to run portfolio ops—no spreadsheets required

Built for Portfolio Managers, Credit Ops, Fund Admins, and Reporting Teams.

Start with Asset Hub as your intel layer, then add Warehouse Engine for rules driven eligibility and Funding Desk for agentled execution. For secondary market workflows, use Sales Desk.

AI Powered Document Extraction

Parse loan docs, agreements, and trackers with field recognition for UPB, maturity, borrower, LTV, and more.

Covenant & Metadata Detection

Detect warehouse reporting terms and financial covenants for compliance readiness.

Real Time Portfolio Analytics

Active UPB, risk flags, maturity timelines, and eligibility summaries in a single view.

Loan Profile Generation

Maintain clean loan records with documents, compliance history, and linked borrowing base data.

Review & Sync Layer

Human-in-the-loop verification before syncing to your system of record or keeping Asset Hub as the intel layer.

Exports & Snapshots

Investor ready exports, cohorts, and point-in-time snapshots you can share instantly.

From raw files to portfolio intelligence in three steps

- Connect & upload. Spreadsheets, trackers, PDFs, agreements.

- Extract & validate. Fields, covenants, and limits with review.

- Analyze & publish. Dashboards and exports; enable Warehouse Engine anytime.

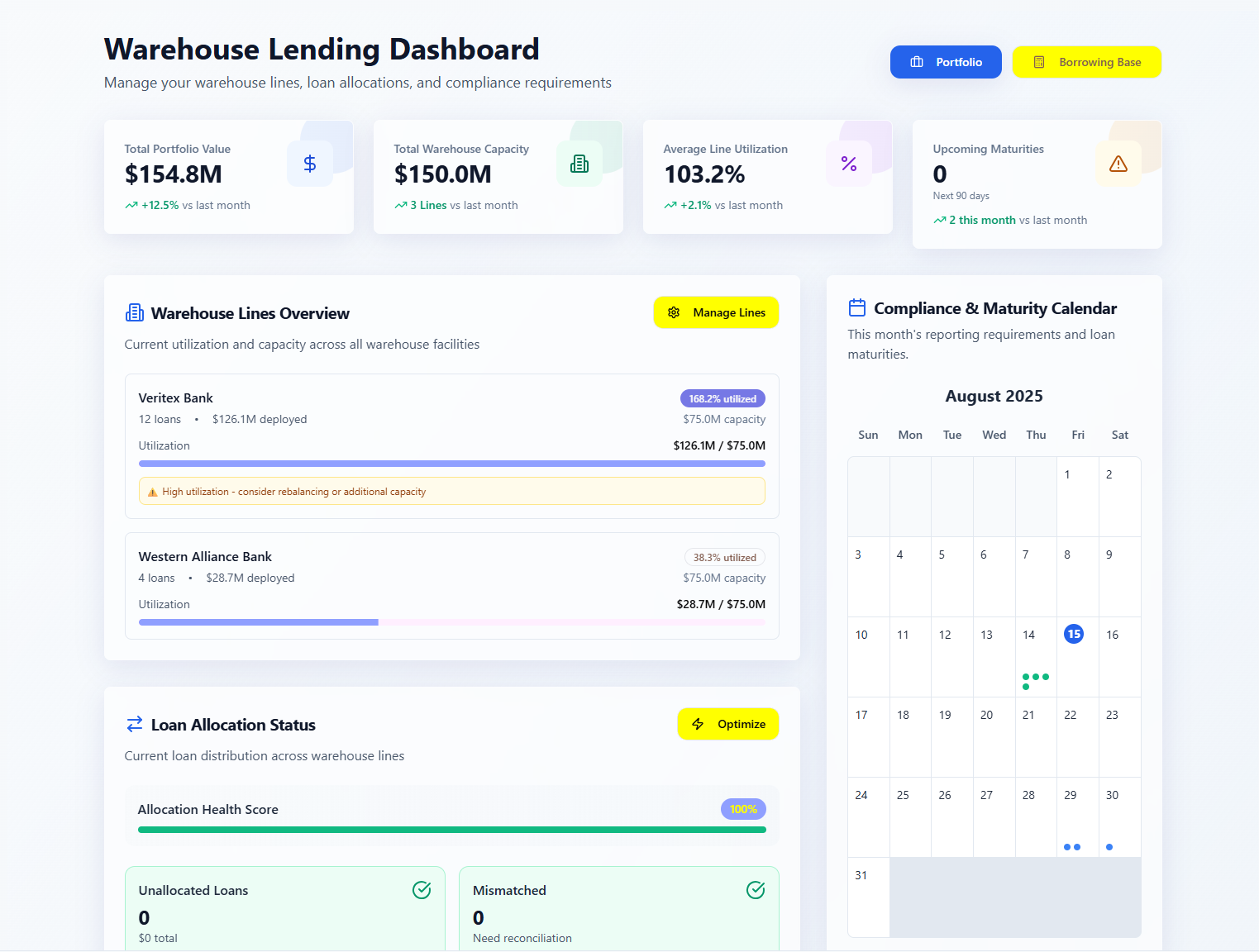

Warehouse dashboard—utilization, capacity, allocation health, and maturities in one view.

Screens you'll actually use

KPIs & Utilization — warehouse overview and maturity ladder at a glance.

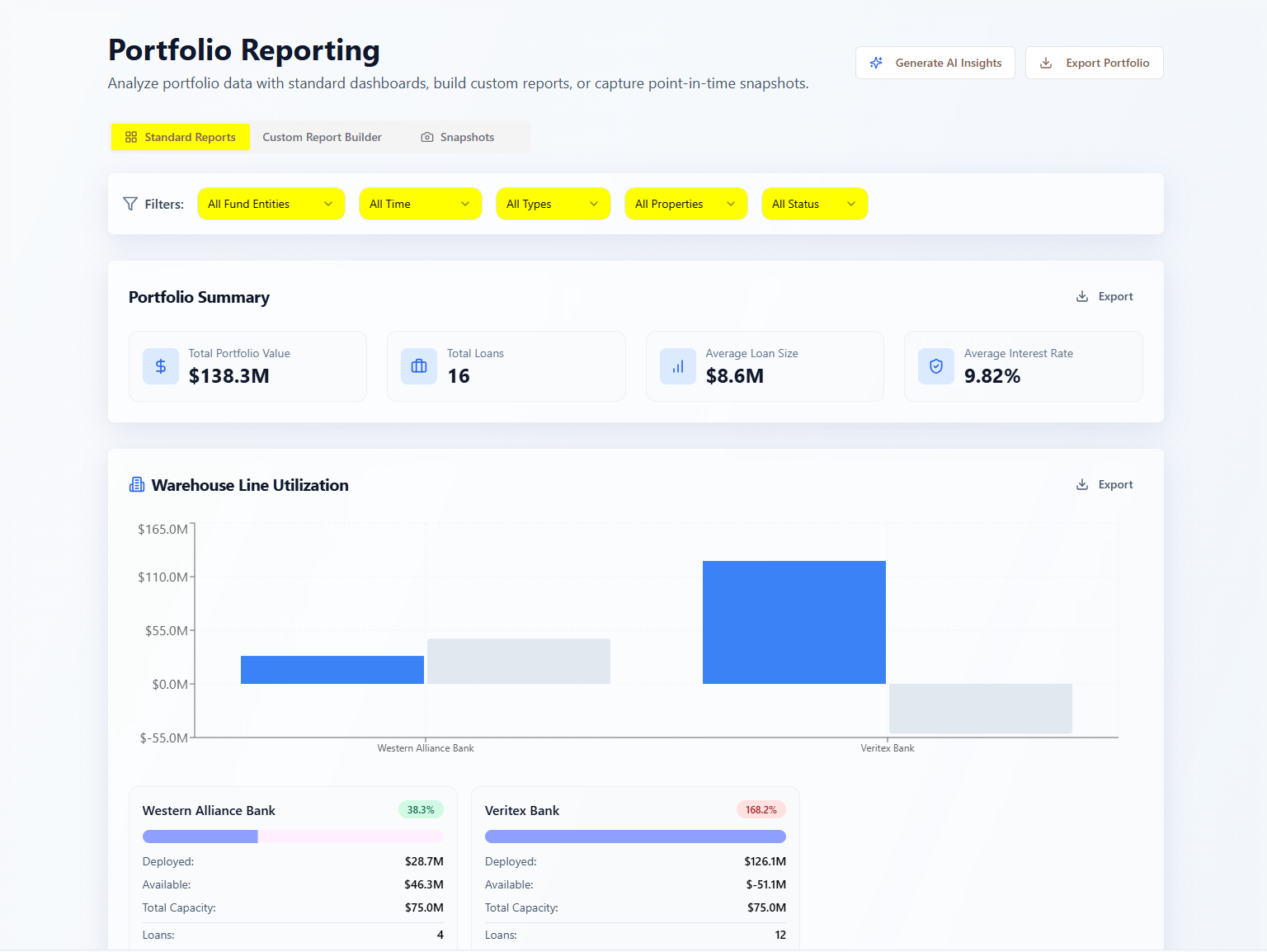

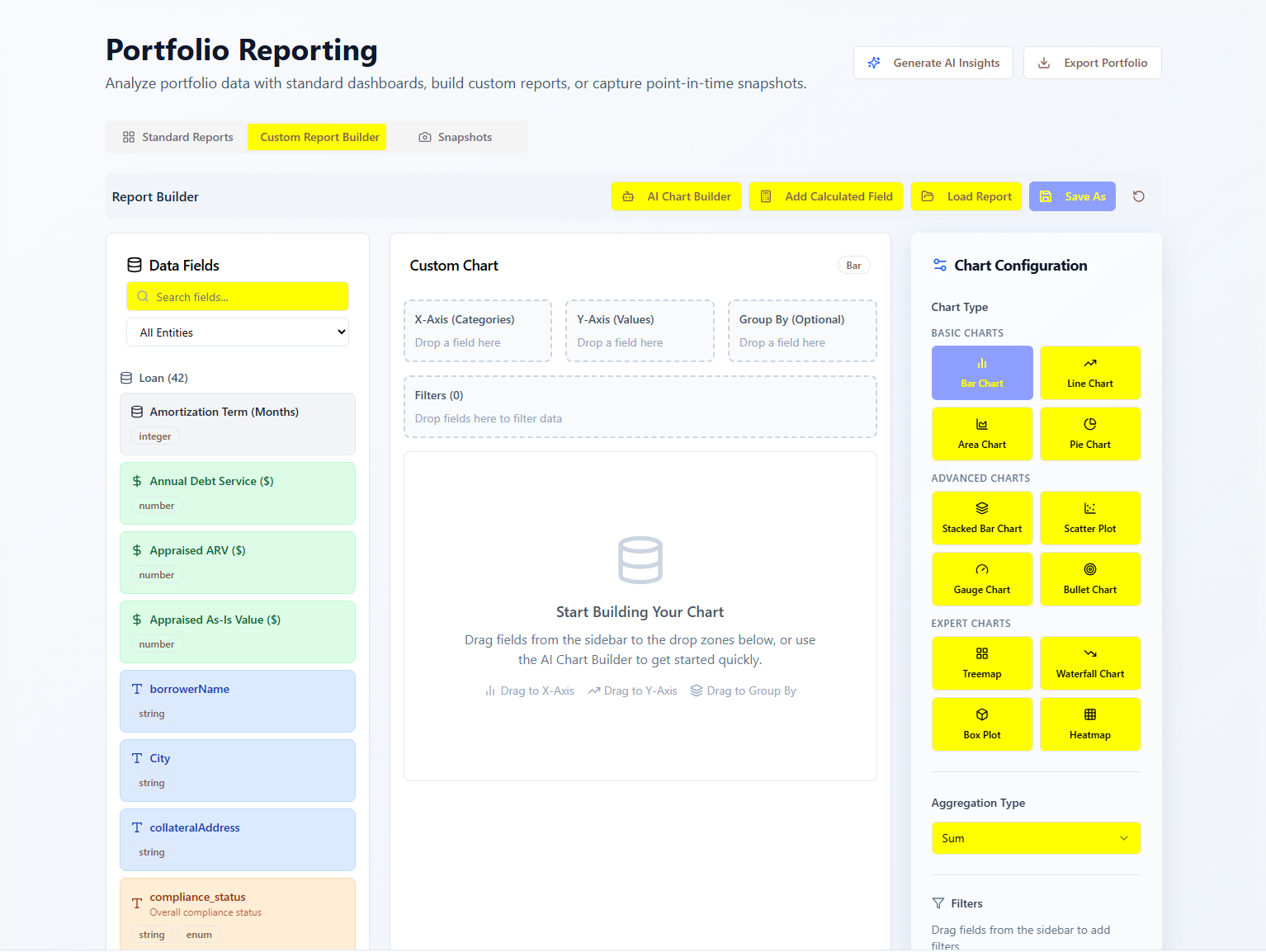

Report Builder — cohorts, custom fields, and point-in-time analysis.

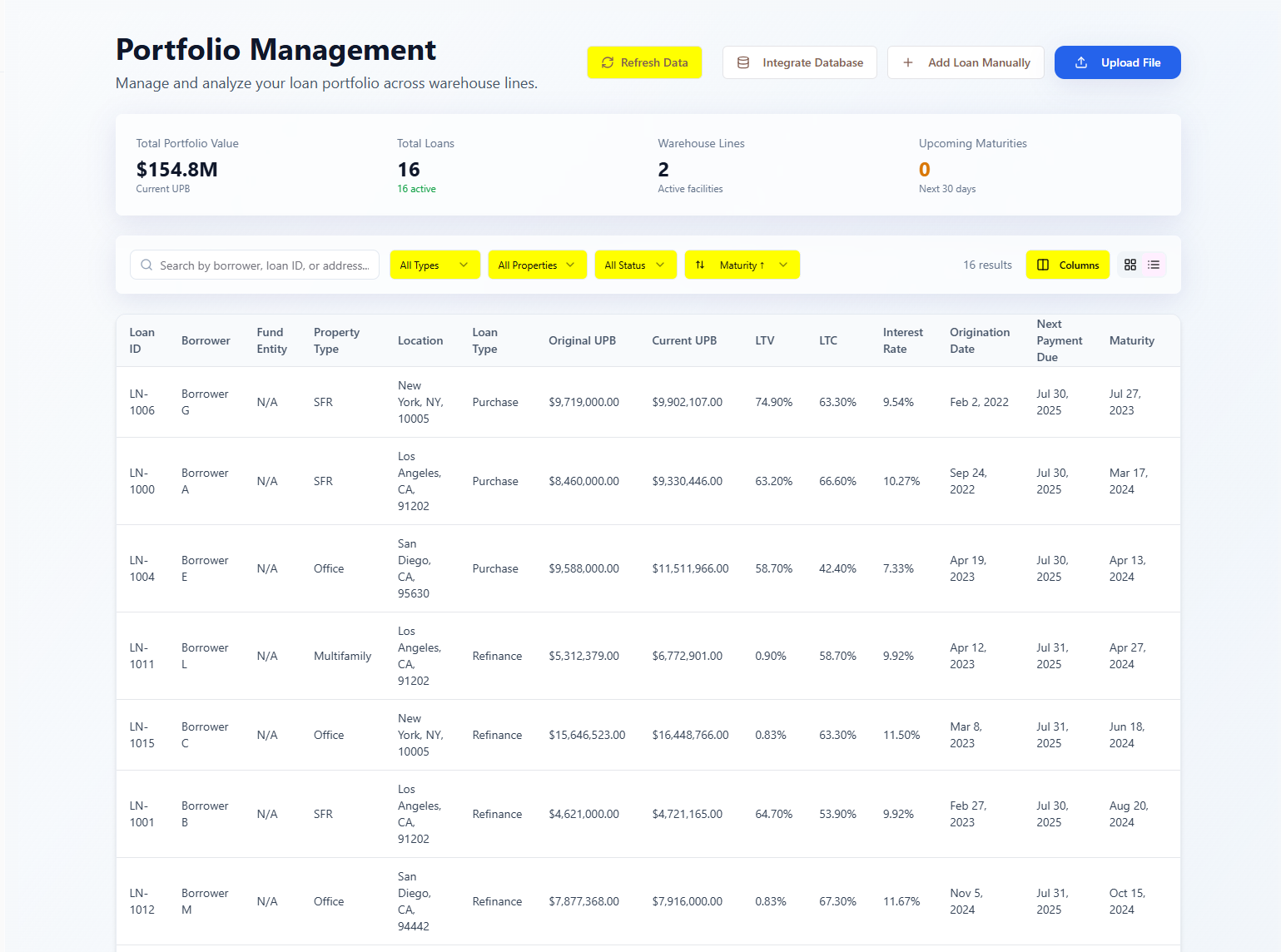

Portfolio Grid — slice, filter, and export investor/lender-ready packs.

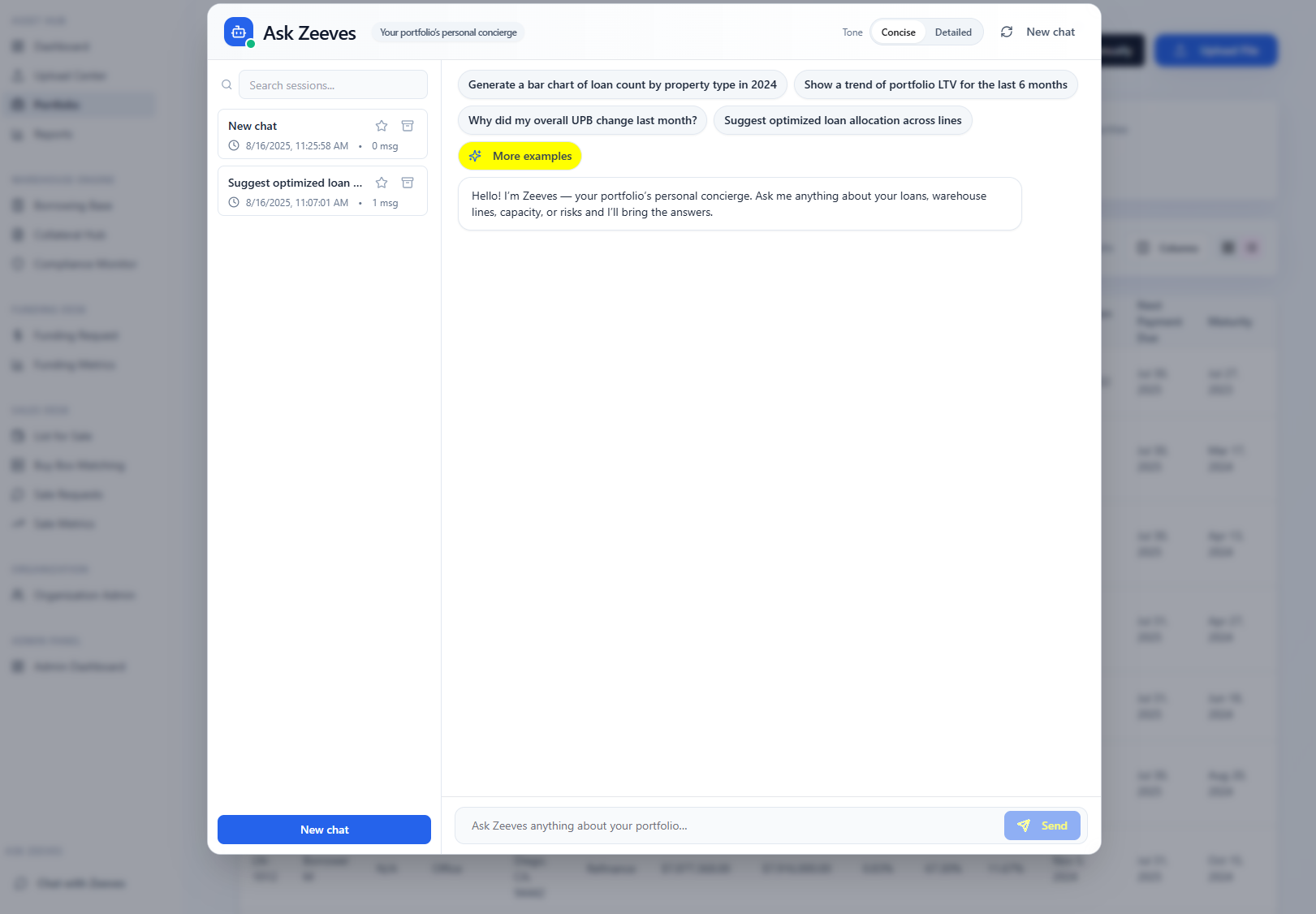

Ask Zeeves — AI search across loans, covenants, and agreements.

Start with Asset Hub. Add Warehouse Engine and Desks when you want execution.

Common questions

See how Asset Hub feeds Warehouse Engine, Funding Desk, and Sales Desk for an end-to-end workflow.

Can I use Asset Hub without changing my current system?

Yes. Many clients run Asset Hub as an intelligence layer on top of their existing trackers/CRMs, using exports for investors and compliance. Two-way sync is optional.

What data sources are supported?

Excel/CSV, PDFs, internal trackers, and bank/warehouse files. We also support API connections for CRMs and data rooms.

How fast can we go live?

Most teams are live in 2—4 weeks, depending on data hygiene and access. Start with a sandbox import, validate outputs, then flip to production.