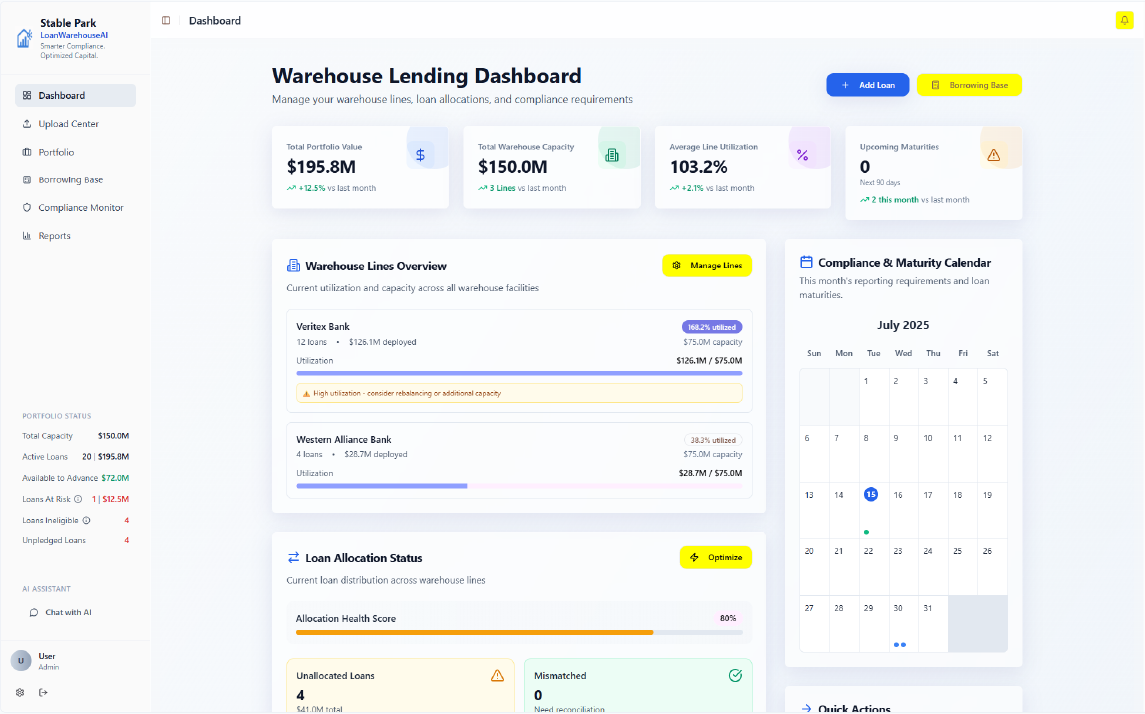

Modular • Scalable • Compliant

AI SaaS infrastructure for modern lending

Whether you manage a small portfolio of loans or operate a complex lending operation, LoanWarehouseAI equips you with domain-specific AI and automation to monitor, analyze, and act with confidence.

80%

Reduction in

manual work

24hr

Capital

execution SLA

2–4wk

Implementation

time