From buy boxes to offers—deal flow without chaos

Ingest buy boxes, score fit against your portfolio, and coordinate LOIs, diligence, and closes in one place. Stop wrangling spreadsheets and inboxes—move faster with a clean audit trail.

Buyer matching, offer management, diligence, and trade analytics

Built for portfolio managers and capital markets teams selling whole loans or pools.

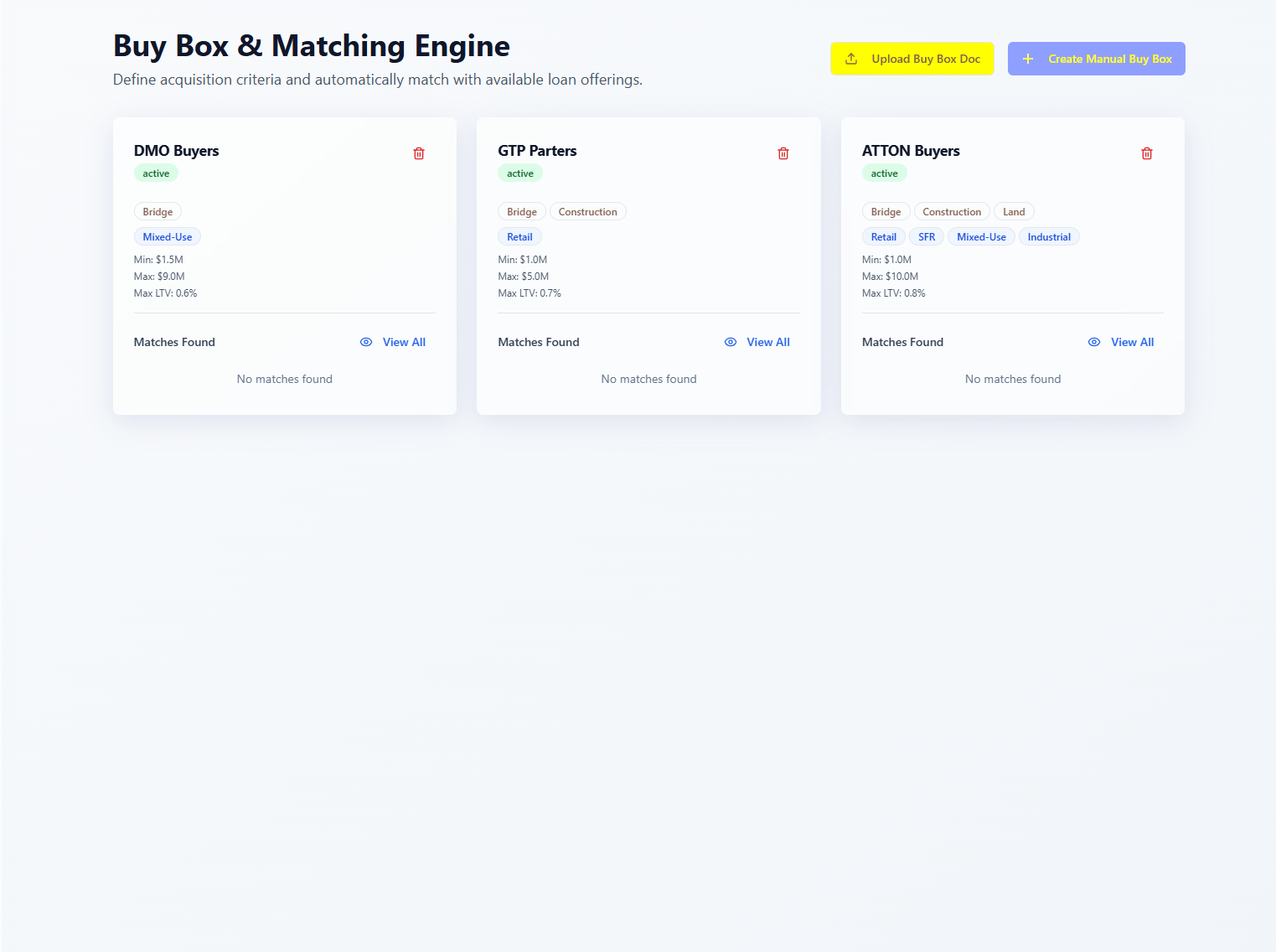

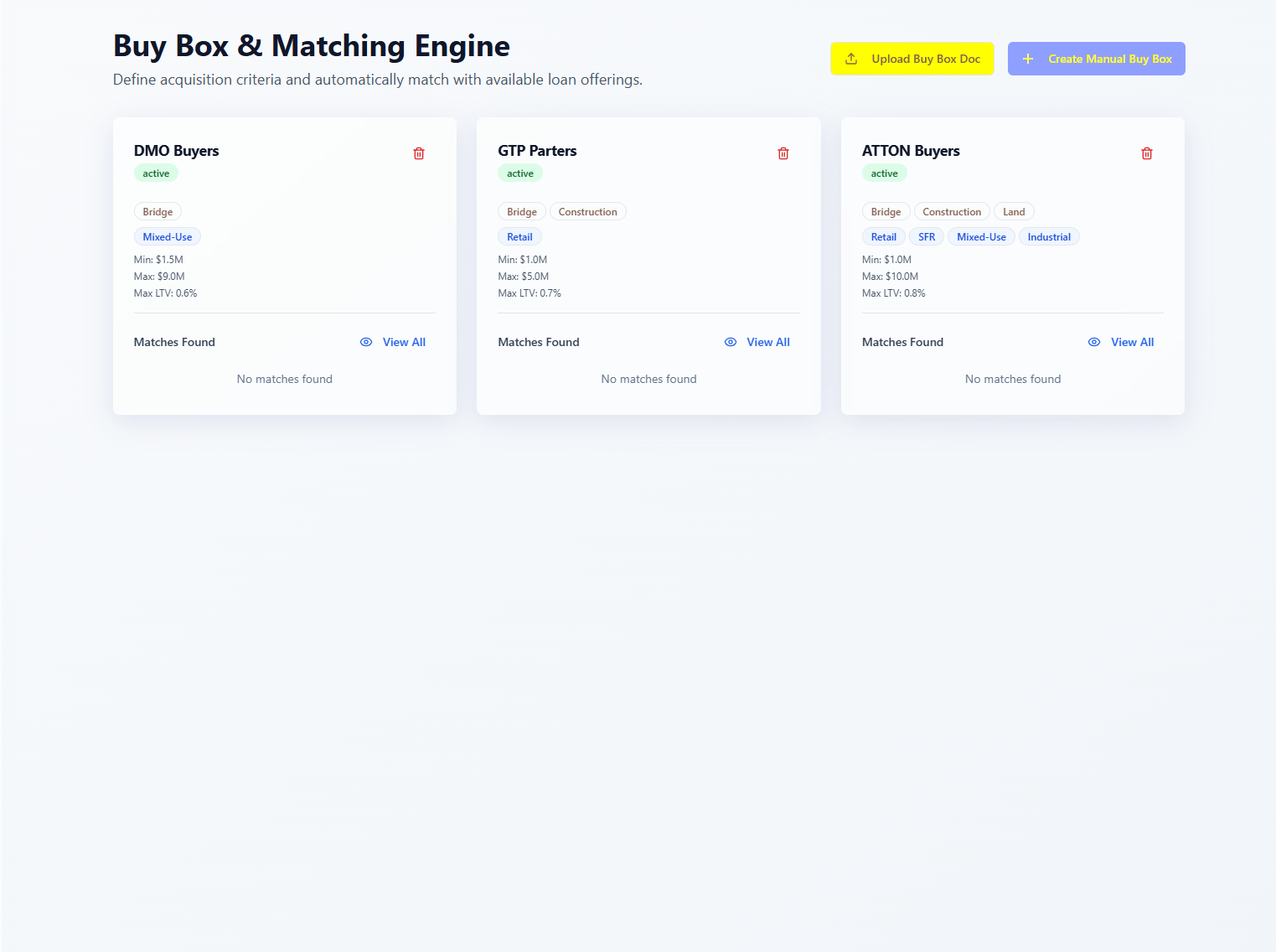

Buyer CRM + Buy Box Ingestion

Structured buyer profiles with asset classes, geos, FICO/LTV bands, coupons, seasoning, and more.

Matching & Scoring

Ranked matches with explainability tags; filter by mandate fit and capacity.

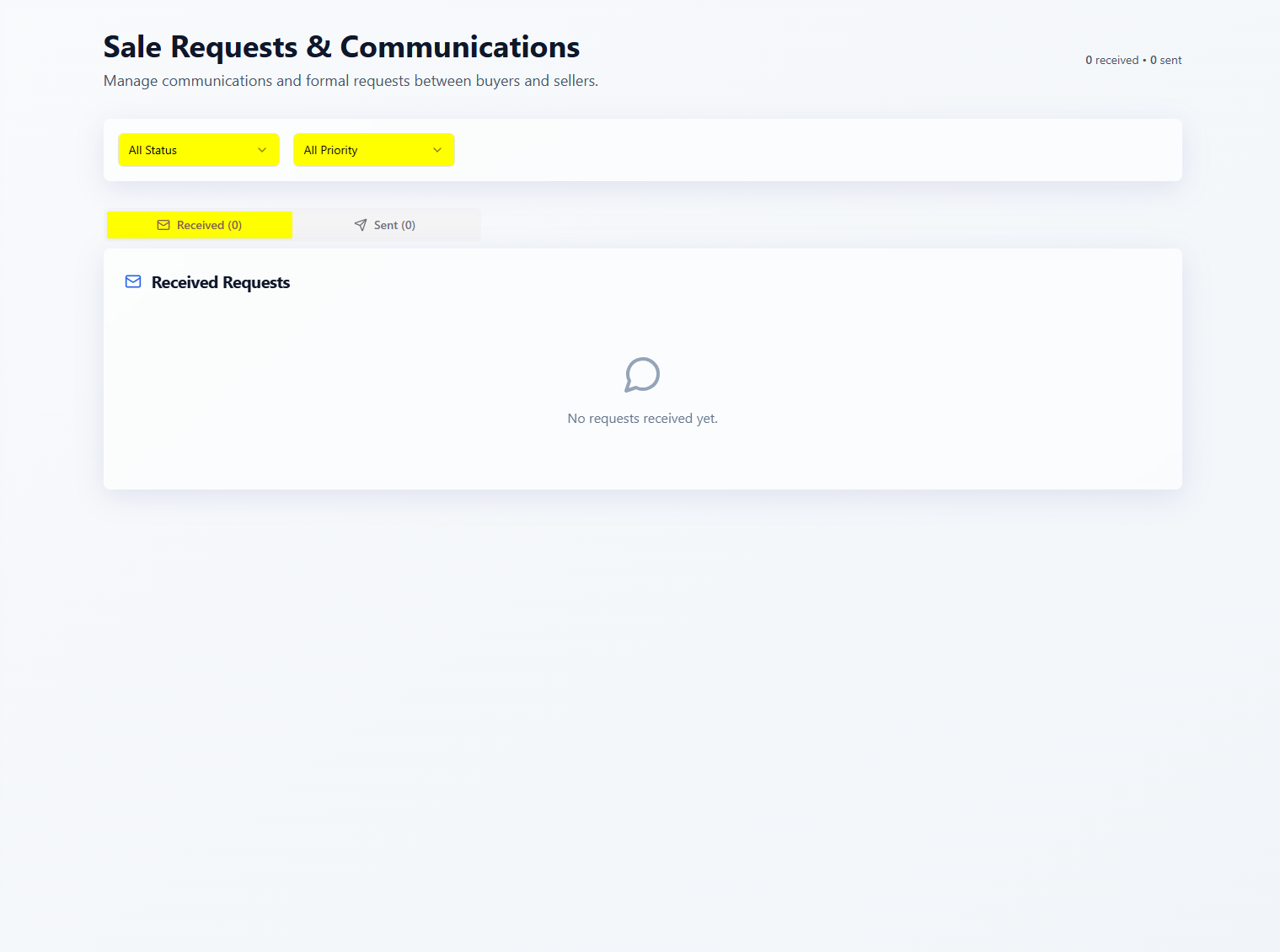

Offer & LOI Management

Solicit, compare, and negotiate offers; track terms, fees, and contingencies.

Diligence Checklist

Centralize diligence requests, docs, and sign offs with reminders and owners.

Trade Analytics

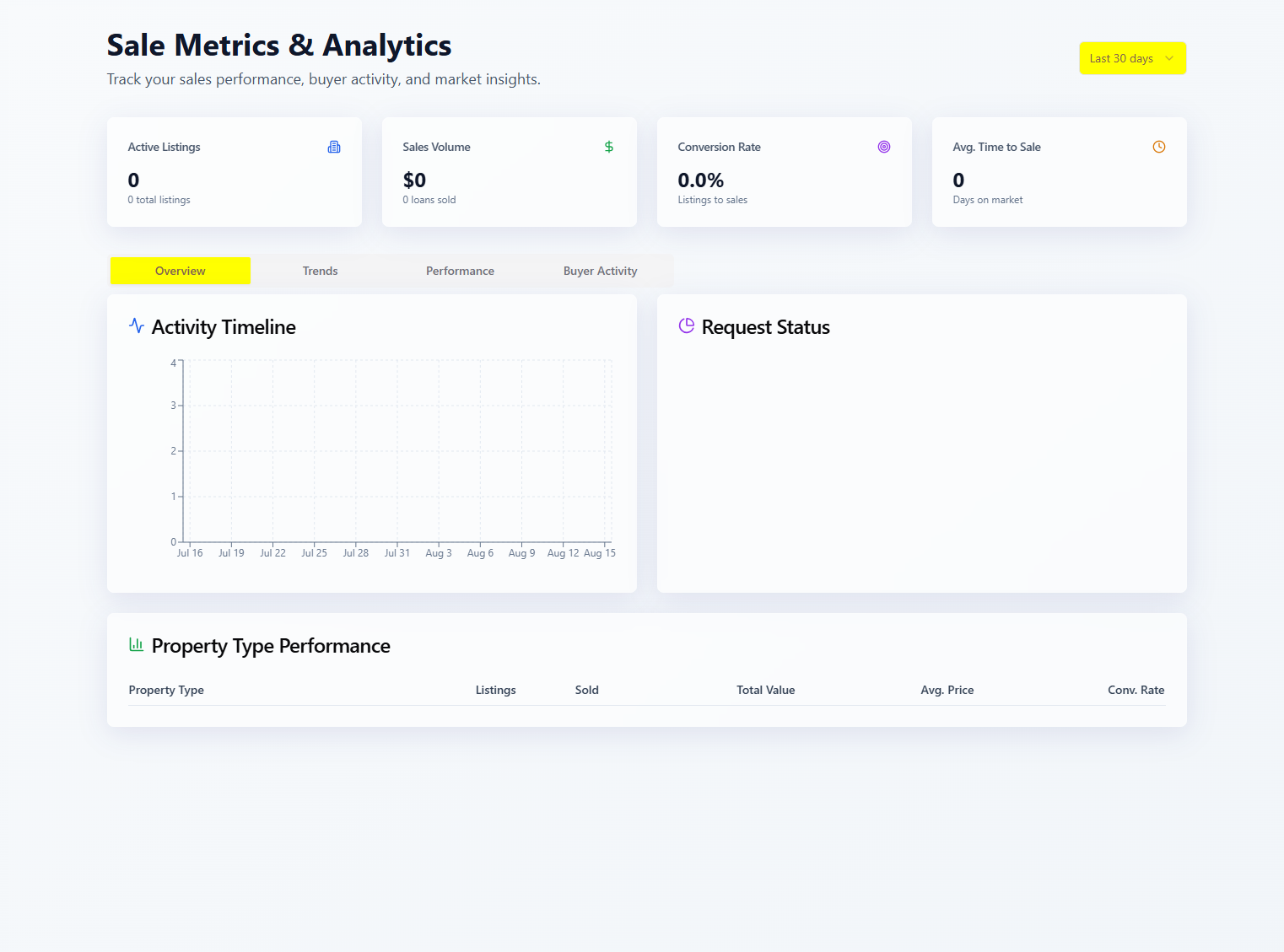

Track execution metrics—pull through, time to LOI, spreads, and win rates.

Audit Trails

Every step logged and exportable; share with investors or buyers as needed.

Ingest → Match → Execute

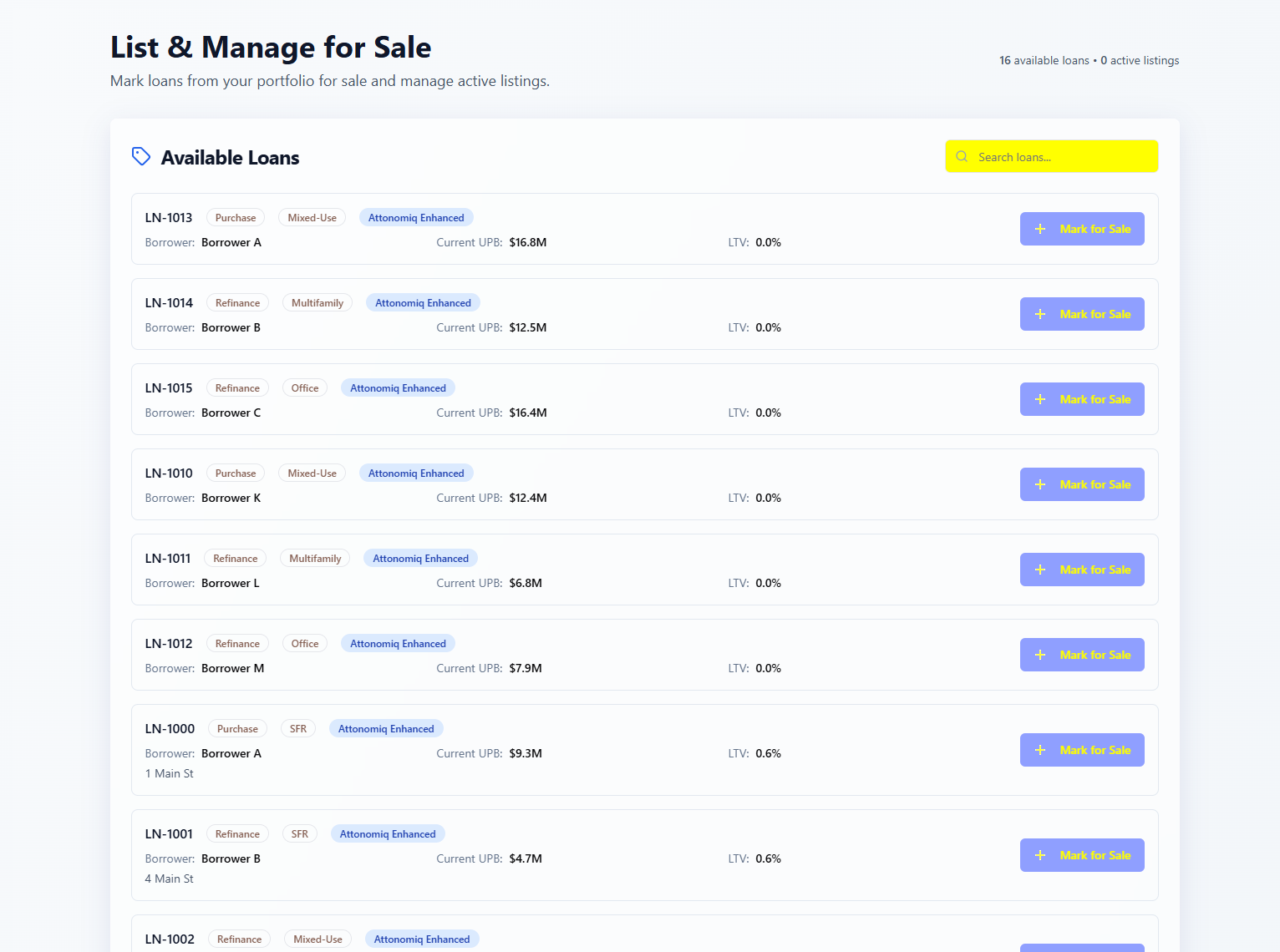

- Ingest. Import buyer lists and buy boxes; or start with our curated network.

- Match. Score your portfolio against mandates; shortlist and solicit offers.

- Execute. Manage offers, diligence, and close with audit trails.

Define buyer boxes; the engine screens your portfolio and surfaces qualified deals.

Screens your team will live in

Unified Offers & LOIs: status, terms, ownership, and SLA tracking.

Buy Box Engine: automated eligibility checks and best-fit matches.

Communications Hub: structured requests, document sharing, clear owners.

Analytics Suite: pull-through, spread trends, time-to-LOI; exportable audit log.

Works standalone, supercharged by Asset Hub & Funding Desk

Common questions

Do I need existing buyer relationships?

No, you can start with your buyers or ours. Import lists and buy-boxes, then match immediately.

Can I customize match scoring?

Yes. Adjust weights by mandate criteria; we show explanations for each score.

How do offers/LOIs work?

We track terms, fees, conditions, and approvals with full version history and exports.

Is execution included?

Execution of capital movement is handled by Funding Desk; Sales Desk manages the sale process and documentation.