From agreements to code: a rules engine that never forgets

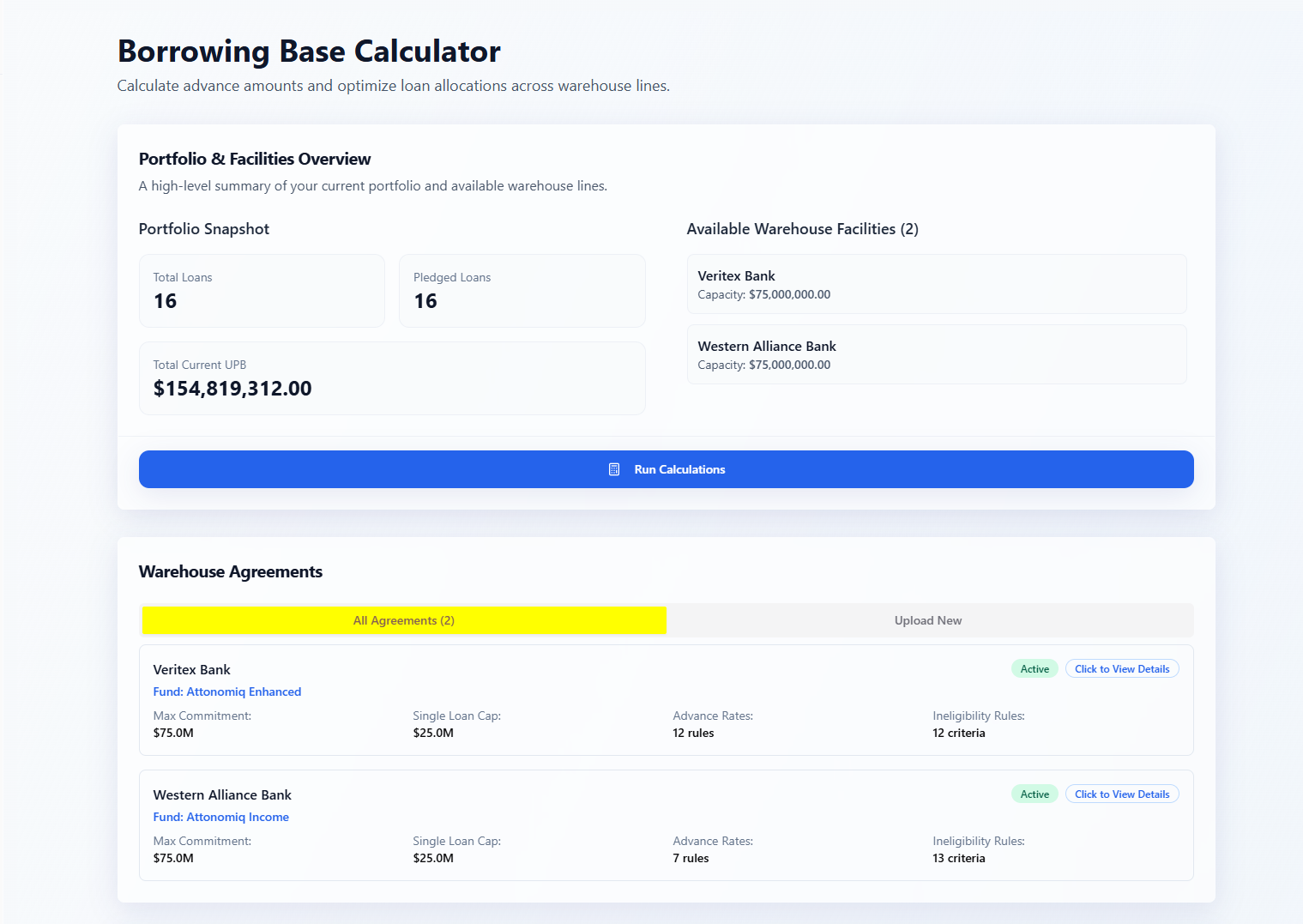

We translate your warehouse agreement into transparent, testable rules: eligibility tests, haircuts, concentration limits, and advance rate schedules. Every calculation is explainable, auditable, and reproducible.

Deterministic eligibility, real time advance rates, airtight auditability

Purpose built for lending ops, capital markets, and fund admins.

Agreement Parsing & Rule Mapping

Convert eligibility clauses, haircuts, and limits into named, versioned rules.

Eligibility Engine

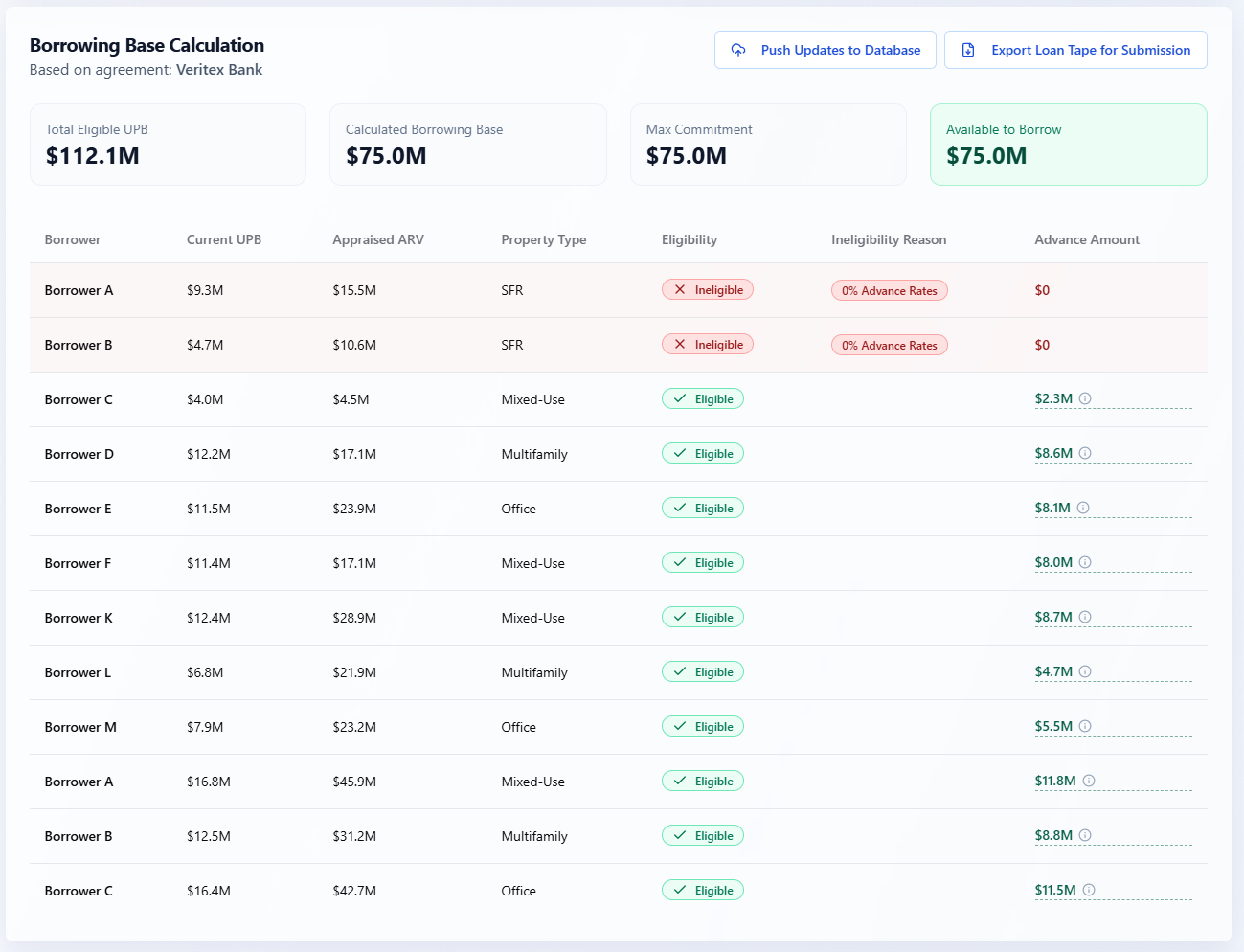

Compute loan level eligibility across rule groups; get explanations for every pass/fail.

Advance Rate Calculator

Apply schedules and haircuts; preview the impact of changes before submission.

Exception Monitor

See breaches and remediation paths in one place; assign owners and due dates.

Allocator

Optimize allocations across lines or investors based on rules and constraints.

Audit & Snapshots

Point-in-time snapshots, change logs, and lender ready exports.

Model → Test → Execute

- Model your agreement. Import clauses, define checks, haircuts, and schedules.

- Test on a sandbox. Validate results with side by side comparisons.

- Execute. Run live eligibility and publish outputs to Funding Desk.

Rules engine view — see named checks, parameters, and pass/fail results.

Screens you'll reference daily

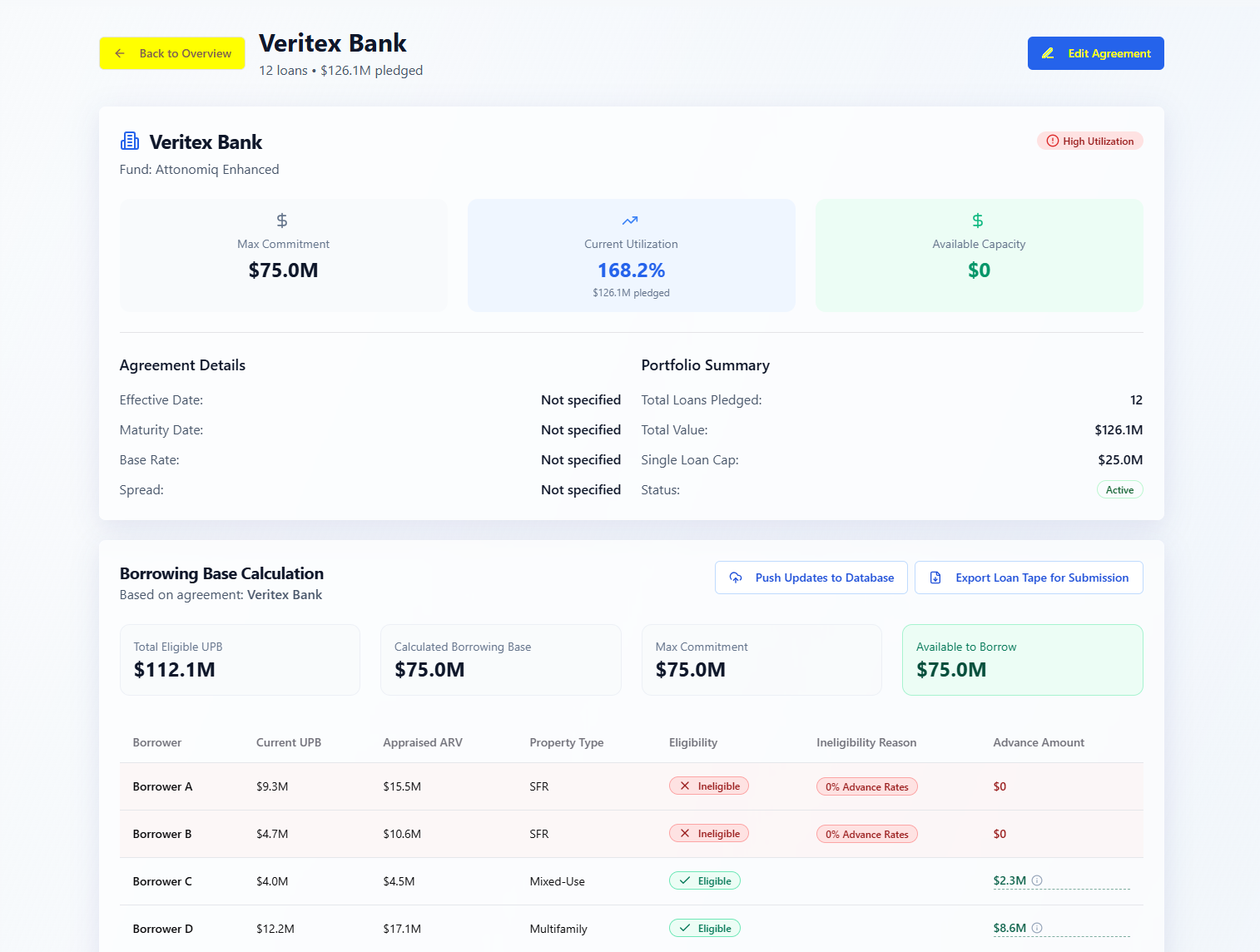

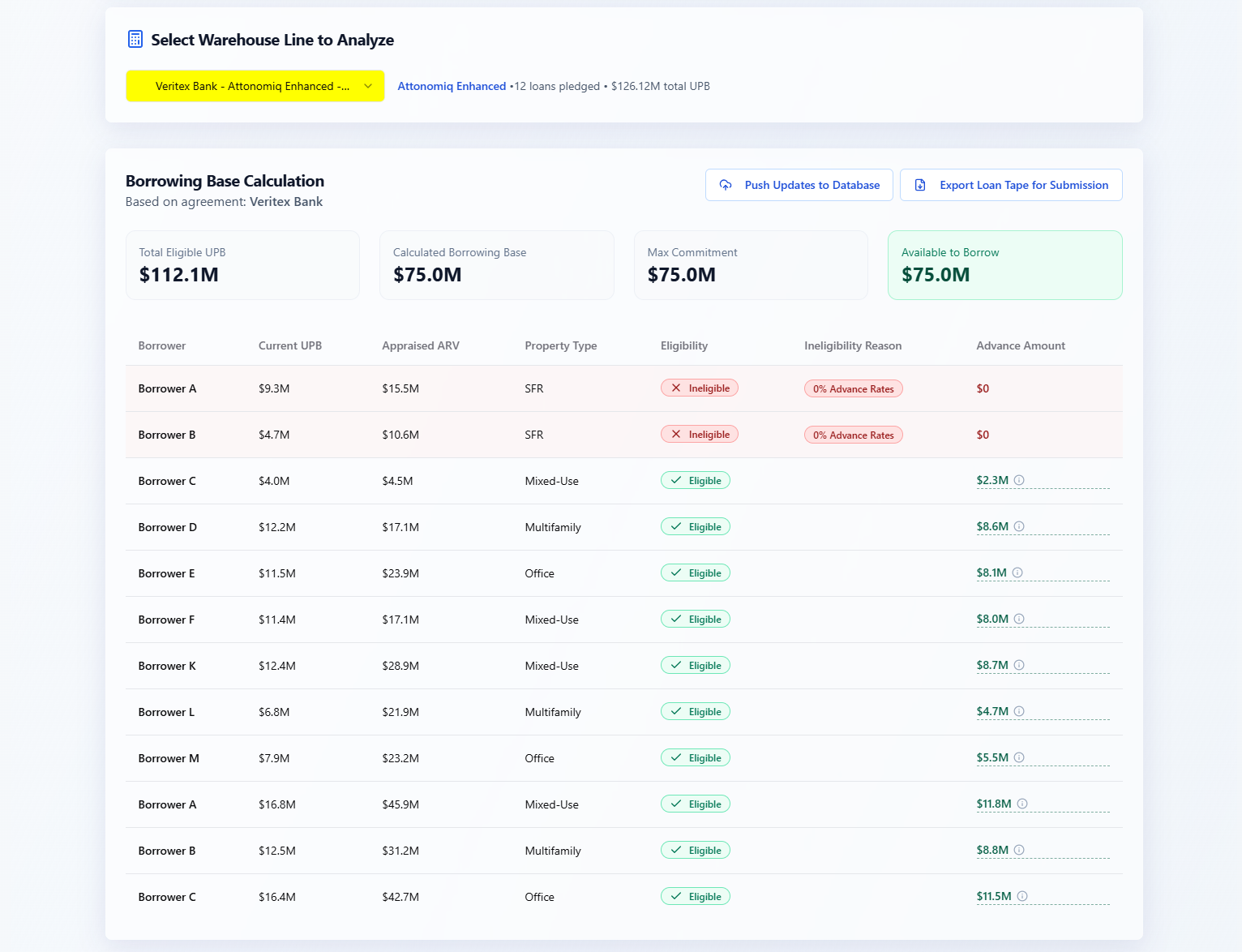

Portfolio eligibility, advance rates, and flagged exceptions in one view.

Row-by-row eligibility and approved advance amounts.

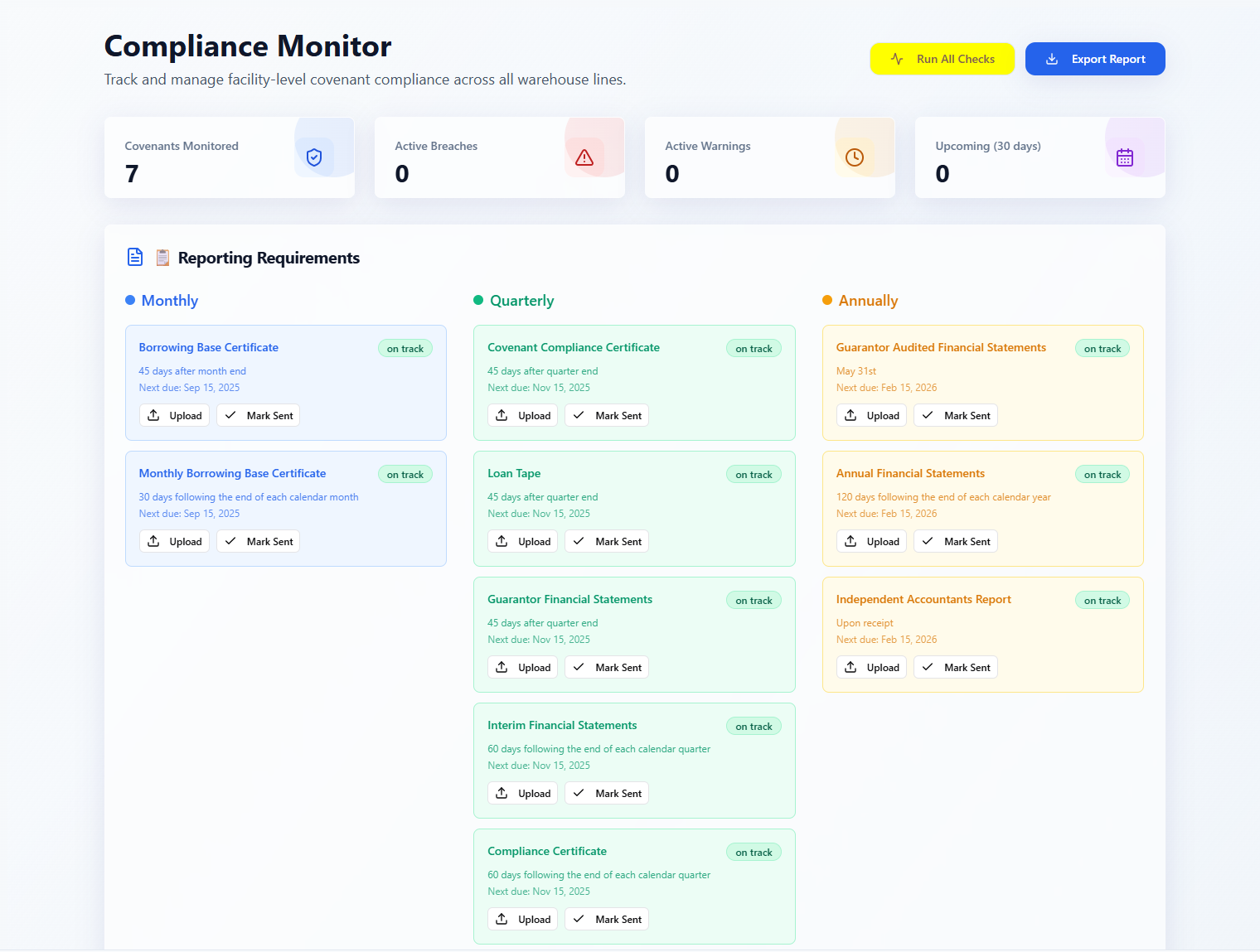

Track covenants and reporting by frequency, due dates, and breach alerts.

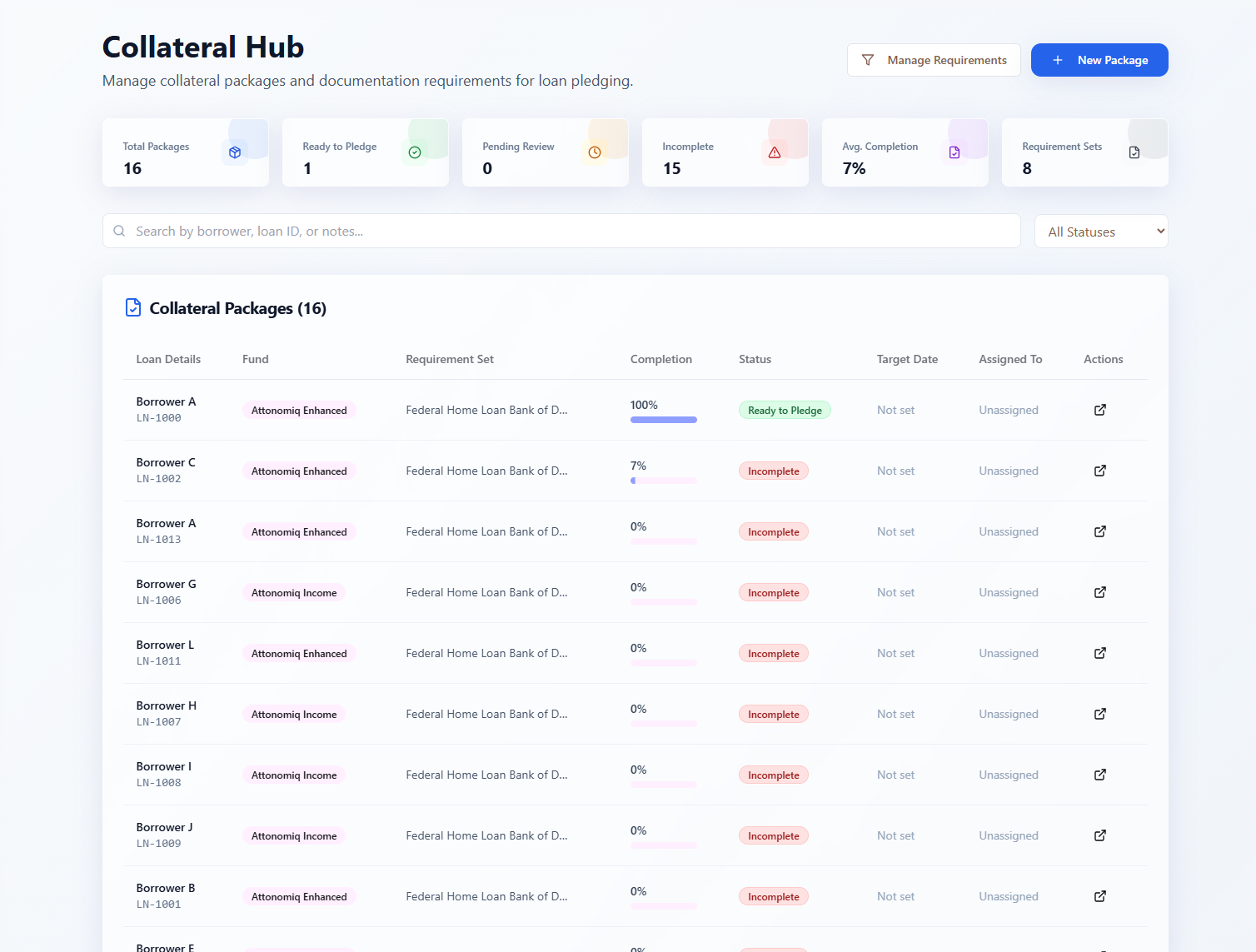

Centralize collateral packages and loan docs ; one-click, lender-ready exports.

Pair with Funding Desk for 24hour capital execution

Common questions

How long to implement?

Most teams go live in 2—4 weeks after a sandbox validation on a representative subset of loans.

Can we customize rules?

Yes. Rules are named, versioned, and parameterized—no black boxes. You can request changes with approvals.

Do we need to change systems?

No. You can export outputs to your existing trackers/CRMs or run two-way syncs when ready.

Is execution included?

Execution is handled by Funding Desk as an add-on for agent led draws/recycles with SLA.